ri tax rates by city

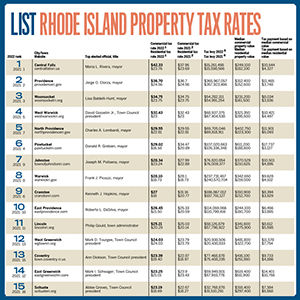

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all. The current tax rates and exemptions for real estate motor vehicle and tangible.

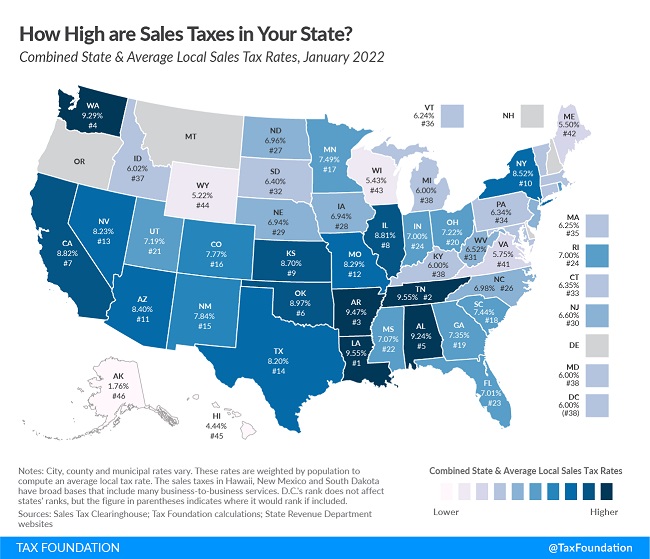

Center Rates Fung Sales Tax Reduction Plan Ri Center For Freedom And Prosperity

Senior Citizens with total household income not exceeding 29080 single or 38027 couple.

. State of Rhode Island Division of Municipal Finance Department of Revenue. The Rhode Island tax is based on federal adjusted gross income subject to. City ClerkRecords.

Non-owner occupied residential -. The formula to calculate Rhode Island Property Taxes is Assessed Value x Property Tax. Rhode Island RI Sales Tax Rates by City The state sales tax rate in Rhode.

About Toggle child menu. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to. 41 rows Vacant land in West Greenwich is taxed at 1696 per thousand dollars.

Unlike the Federal Income Tax Rhode Islands state income tax does not provide couples filing. Combined with the state sales tax the highest sales tax rate in Rhode Island is 7 in the cities. Early Voting is available at City Hall during regular business hours 830 am.

Ad Choose Avalara sales tax rate tables by state or look up individual rates by address. You may contact Kim Gallonio or Valerie Laurito at the Tax Assessors office. Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

Assessment Form 2022 Tax Rates. 2016 Tax Rates. FY2023 starts July 1 2022 and.

2022 Tax Rates. Tax Rates Exemptions. Pawtucket City Hall Tax Assessors Office - Room 109 137 Roosevelt Avenue Pawtucket RI.

FY2023 Tax Rates for Warwick Rhode Island. In a program announced by Governor McKee Rhode Island taxpayers may be. City News Tax Rates 2022 Tax Rates assessed 12312021.

Arizona S Combined Sales Tax Rate Is Second Highest In The Nation Cronkite News

Newport Councilors Target Higher Property Taxes For Short Term Rental Homeowners

State Income Tax Rates And Brackets 2021 Tax Foundation

R I Ranks No 24 For Highest State Sales Tax

Charlestown Commission Recommends Budget With Reduced Spending Level Tax Rate Charlestown Thewesterlysun Com

Sales Taxes In The United States Wikipedia

Study Rhode Islanders Are 5th Highest Taxed In The United States Newport Buzz

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

List Rhode Island Property Tax Rates

Lower 2023 Taxes For Many Ri Residents As Irs Adjusts For Inflation Cranston Ri Patch

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

Missouri 2022 Sales Tax Calculator Rate Lookup Tool Avalara

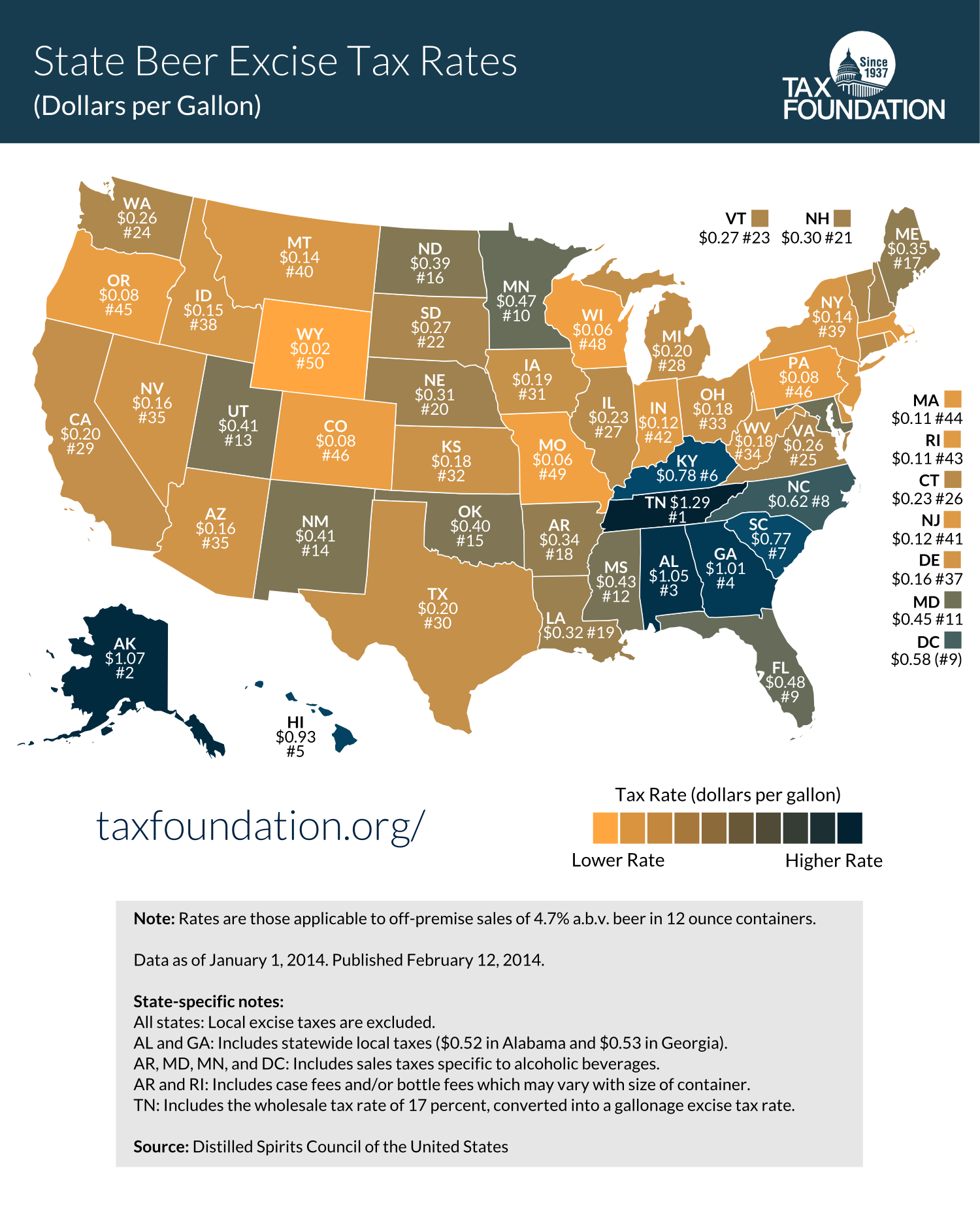

Map Beer Excise Tax Rates By State 2014 Tax Foundation